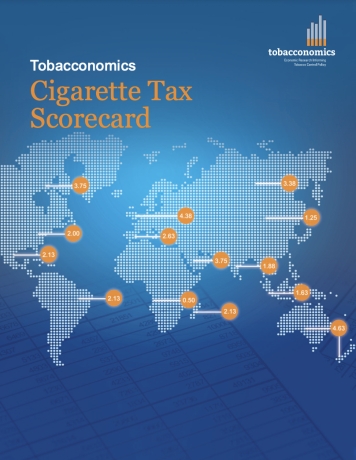

Tobacconomics Scorecard Shines a Light on the Untapped Potential of Countries' Cigarette Tax Policies

On December 15, 2020, Tobacconomics released the first edition of the international Cigarette Tax Scorecard, assessing the performance of cigarette tax policies in over 170 countries. Read More

Introducing Tobacconomics’ Tobacco Control Supplement: “The Economics of Tobacco Taxation in Low- and Middle-Income Countries"

Last year, we released a blog series describing the Tobacconomics approach to building think tank capacity. As the project concludes its fourth year, our partners have become adept at producing high-quality research on the economics of tobacco taxation. In this blog, we want to share some lessons learned over the past four years as well as overview our partners’ contributions to the recently released Tobacco Control Supplement. Read MoreNew Study Uses Four Different Approaches to Estimate Illicit Cigarette Trade in Brazil

Understanding the scope and nature of illicit cigarette trade is necessary for well-functioning administration. Analysis of illicit trade is needed to guide law enforcement activities, as it provides vital intelligence to customs, police, and other relevant agencies to protect markets and consumers from the inflow of illicit products. Additionally, since the effectiveness of tobacco control measures, including the effectiveness of tobacco taxation, is affected significantly by the availability of illicit products, knowledge about the scope of illicit cigarette trade helps policymakers evaluate newly-implemented tobacco control policies as well as predict the impact of future policies. Read More

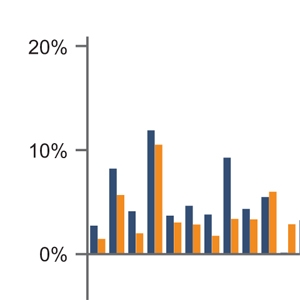

The Pass-Through of Alcohol Excise Taxes to Prices in OECD Countries: Filling In the Evidence Gap

Increasing alcohol excise taxes is the most effective regulatory policy to reduce excessive drinking and related harms. Tax pass-through rates measure how much prices increase when taxes are increased by one unit – a critical step in the mechanism of excise taxes as an alcohol control policy. If prices are increased more than tax increases (i.e., tax pass-through rate > 1), the reduction of alcohol consumption will be higher, and vice versa. Read More

World No Tobacco Day 2020: Tobacco Taxes Are a Powerful Tool Against Tobacco Industry Efforts to Attract Youth

Sunday, May 31, 2020 is World No Tobacco Day and this year’s theme focuses on efforts by the tobacco industry to target young people. Raising tobacco taxes is one of the most effective tobacco control policy tools to discourage tobacco use in the overall population, but even more so for young people. In observation of World No Tobacco Day, this Tobacconomics blog entry highlights research from our partners around the world that demonstrates how increasing taxes on tobacco products is a particularly effective policy to prevent and reduce tobacco use among young people. Read More

A Closer Look at Tobacco Tax Progressivity: New Research from UIC Think Tank Partners in Latin America

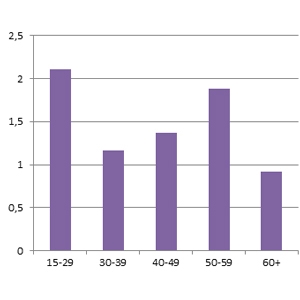

Most research on the distributional impacts of tobacco taxation focuses on the shift in the tax burden for different income groups that occurs immediately after a tax increase. In most countries, poorer people spend proportionately more of their income on tobacco products, and they are much more sensitive to tax increases. Thus, when faced with a tax increase, their consumption of tobacco decreases more, relative to people who are older or with higher incomes, either through cessation, decreased intensity of consumption, or not starting to smoke at all. Read More

Tobacconomics Partners Share Tobacco Tax Research Findings at ECToH

The 8th European Conference on Tobacco or Health (ECToH) took place in Berlin, Germany last week. Tobacconomics team members and Southeastern European think tank partners all participated and presented their research. Here now are the highlights. Read More