|

|

New and upcoming from

Economics for Health:

Launching a tax modeling tool, research releases, & policy engagement

|

|

|

|

At Economics for Health, we have had a busy first half of 2025! We worked with our in-country think tank partners to release 27 reports, briefs, working papers, & other publications on tobacco, alcohol, & more.

Importantly, alongside our partners, we shared these findings & provided technical assistance to policy makers and other stakeholders through roundtables, meetings, & the media.

Next week, we are hosting a webinar to launch a new tool over on Tobacco Atlas, which allows users to calculate how tobacco taxes can be used to recover the economic costs from smoking.

|

|

|

|

|

|

Launching our new Cost Recovery and Revenue Estimator

|

We are so excited to announce a new, interactive tool on Tobacco Atlas with our colleagues from Vital Strategies & American Cancer Society!

|

| |

|

|

| |

|

|

| |

|

|

|

Join us for a webinar on Tuesday, June 17 at 8am ET to learn about the Cost Recovery and Revenue Estimator, or "CoRRE," which shows how countries can use tobacco taxes to:

- generate millions in new tax revenue,

- reduce smoking prevalence,

- increase economic productivity, &

- recover millions in tobacco-related medical expenses.

|

|

|

|

|

|

Engaging in timely & relevant research with think tanks

|

|

|

Producing high-quality economic research on tobacco control & tobacco taxation remains central to our work. So far this year, we have:

- Modeled the impact of raising tobacco taxes on consumption, premature tobacco-related deaths, & tax revenue in Bangladesh and Slovakia;

- Evaluated the legal & illegal markets for cigarettes in Jordan and Pakistan;

|

|

|

|

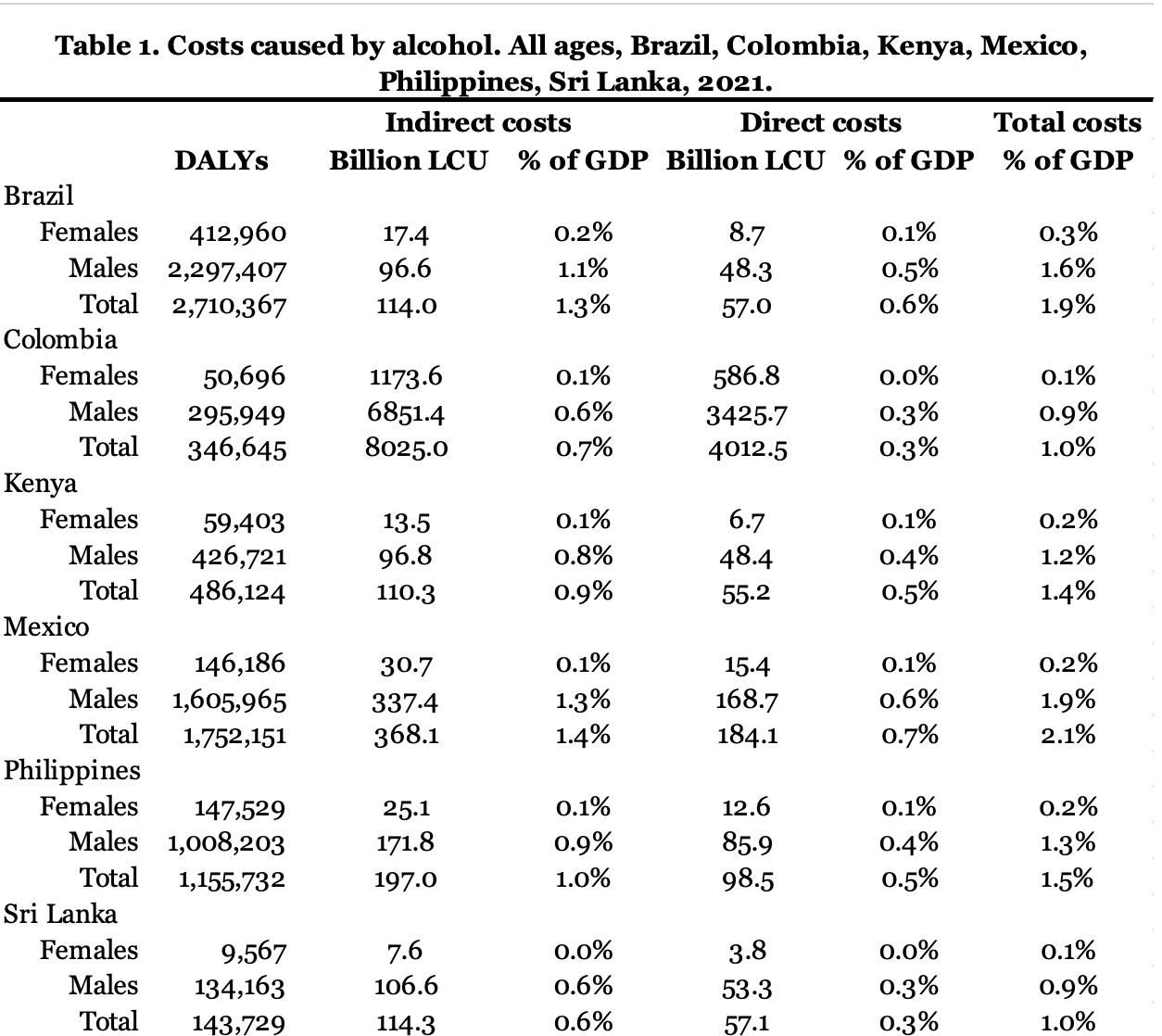

As part of the RESET Alcohol Initiative, we worked closely with partners to inform more effective alcohol control policies, especially taxation. We have:

- Modeled the impact of raising alcohol taxes on different income groups in Montenegro;

- Estimated the substantial economic costs of alcohol consumption in Brazil, Colombia, Kenya, Mexico, Philippines, and Sri Lanka.

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

|

Strengthening collaboration with stakeholders

|

Translating the evidence we produce into policy requires close engagement with policy makers alongside our think tank partners, especially during tax reform discussions. For example:

- In Brazil, we are working with UCB to provide technical support to decision makers to achieve their desired decrease in consumption & excise tax revenue targets within the country's broader VAT tax reform.

- In Montenegro, we are working with ISEA to collaborate with the Minister of Finance and other key actors on tobacco taxation, setting an example for neighboring countries, and promoting regional coordination.

- In Pakistan, we are supporting SPDC with reaching the media to refute industry claims, especially regarding illicit trade.

- In Viet Nam, we are working with DEPOCEN and other partners to inform more effective tobacco tax policies in the national excise tax reform discussion.

- Our teams in Egypt, Lebanon, Montenegro, North Macedonia, and Pakistan organized research dissemination events to share findings & the policy implications of their studies.

|

|

|

|

Thank you for supporting our work!

We are excited to see what the rest of 2025 has in store as we continue to work with stakeholders to push for better policies on tobacco, alcohol, and more.

|

|

|

|

Johns Hopkins Bloomberg School of Public Health -

Economics for Health

|

|

615 N Wolfe St, Baltimore, MD 21205

|

|

This email was sent to {{contact.EMAIL}}

|

|

You've received this email because you've subscribed to our newsletter.

|

|

|

|

|

|

|

|

|